In a move that has sent ripples through the global semiconductor industry, NVIDIA has ordered its suppliers—including Samsung Electronics, Amkor Technology, and Foxconn—to halt production of its H20 AI chips. Designed specifically for the Chinese market, the H20 was part of NVIDIA’s strategy to comply with U.S. export restrictions while still serving one of the world’s largest AI markets. But mounting scrutiny from Chinese regulators and shifting geopolitical dynamics have forced a dramatic recalibration.

This decision marks a turning point not only for NVIDIA’s China operations but also for the broader conversation around AI chip sovereignty, national security, and global supply chain resilience.

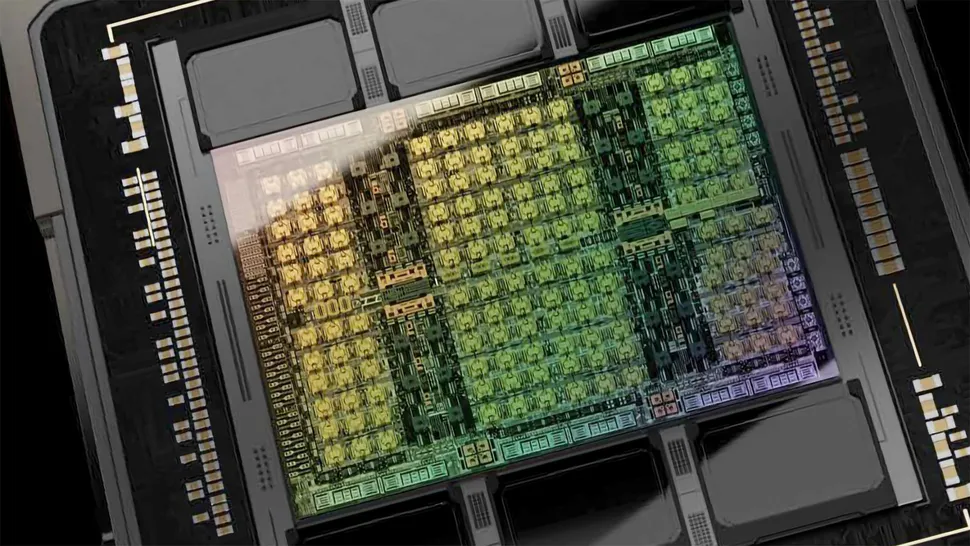

What Is the H20 Chip?

The H20 is a lower-spec AI accelerator based on NVIDIA’s Hopper architecture. It was developed as a workaround to U.S. export controls that barred the sale of high-end GPUs like the A100 and H100 to China. While less powerful than its Western counterparts, the H20 was still capable of supporting large-scale AI workloads, making it a popular choice among Chinese tech firms.

NVIDIA had reportedly ordered hundreds of thousands of H20 units from TSMC earlier this year, anticipating strong demand following a temporary greenlight from Washington in July.

Why Production Was Halted

The production freeze comes after Chinese authorities summoned major domestic companies—including Tencent and ByteDance—to discuss concerns over the H20 chip’s security implications. State media and cyberspace regulators raised alarms about potential information risks, despite NVIDIA’s repeated assurances that the chip contained no backdoors or tracking mechanisms.

CEO Jensen Huang, during a visit to TSMC in Taipei, reiterated that the H20 is not a military-grade product and poses no national security threat. “We’ve made very clear that H20 has no security backdoors. There never has been,” Huang stated.

Nonetheless, the reputational pressure on Chinese buyers and the regulatory uncertainty surrounding U.S.–China tech relations have made the H20 a liability rather than an asset.

Impact on Suppliers

NVIDIA’s directive affects several key suppliers:

- Samsung Electronics: Provided high-bandwidth memory for the H20

- Amkor Technology: Handled advanced packaging

- Foxconn: Managed assembly and logistics

These companies now face halted production lines and inventory reshuffling. Semi-finished H20 units are reportedly piling up at Amkor’s facilities, awaiting further instructions.

The disruption underscores the fragility of global chip supply chains, especially when caught in the crossfire of geopolitical tensions.

Strategic Implications for NVIDIA

This isn’t just a tactical pause—it’s a strategic pivot. NVIDIA is now reportedly developing a successor to the H20, dubbed the B30A, based on its new Blackwell architecture. The B30A is expected to offer improved performance while staying within the bounds of U.S. export regulations.

However, approval for the B30A’s sale to China is still pending, and Huang emphasized that the final decision rests with the U.S. government. “We’re in dialogue, but it’s too soon to know,” he said.

In the meantime, NVIDIA plans to work through existing H20 inventory and focus on markets with fewer regulatory hurdles.

Broader Market Impact

The halt in H20 production has several ripple effects:

- Chinese Tech Firms: May accelerate their shift toward domestic AI chips from companies like Huawei and Cambricon

- Global Investors: Are watching closely as NVIDIA’s China revenue faces potential headwinds

- Competitors: AMD and Intel may seize the opportunity to expand their footprint in China with alternative offerings

- U.S. Policy Makers: Will likely use this episode to reinforce the importance of export controls and tech sovereignty

This development also raises questions about the long-term viability of “China-specific” chips. If regulatory scrutiny continues to escalate, companies may be forced to abandon regionally tailored products in favor of globally compliant designs.

What This Means for AI Innovation

The H20 saga highlights a growing tension between innovation and regulation. On one hand, companies like NVIDIA are pushing the boundaries of AI hardware. On the other, governments are increasingly concerned about who controls these technologies and how they’re used.

For AI developers and data center operators, this means navigating a more complex landscape—one where chip availability, compliance, and geopolitical risk are as important as performance specs.

Final Thoughts

NVIDIA’s decision to halt H20 production is a bold but necessary move in a rapidly evolving global tech environment. It reflects the company’s agility, its commitment to compliance, and its willingness to adapt to market realities.

As the AI arms race intensifies, expect more such pivots—not just from NVIDIA, but across the semiconductor industry. The future of AI hardware will be shaped not only by engineering breakthroughs but also by diplomacy, regulation, and strategic foresight.